ECB Tone Meter

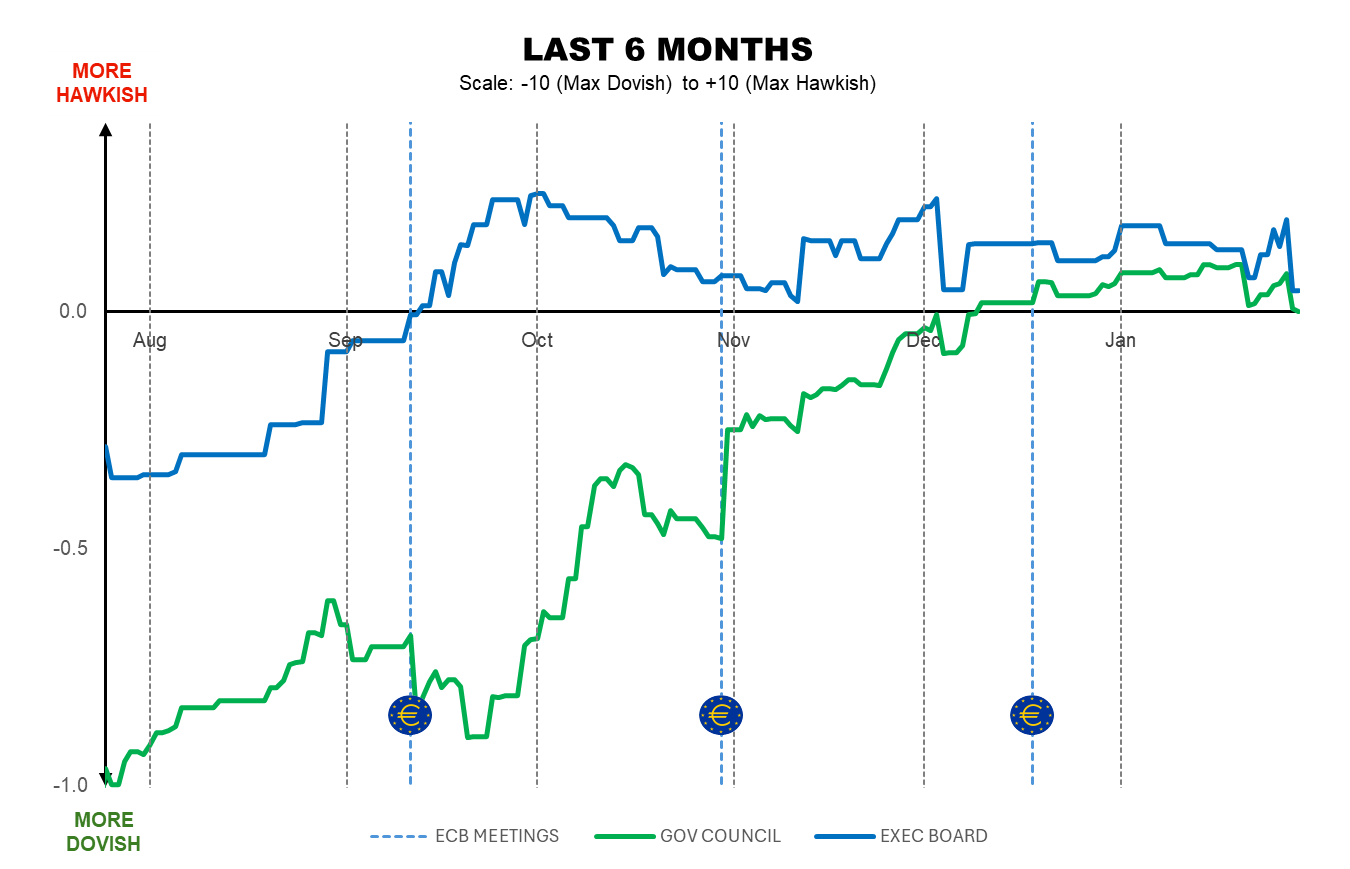

The ECB Tone Meter is an index measuring the overall dovishness or hawkishness of recent communications from the ECB Governing Council, factoring in all member public speeches and communications.

This provides a quantitative tool to summarize and analyze multiple qualitative inputs to provide a point estimate of the current tone, assess how it has evolved over time, and ultimately provide clues on potential future policy action.

Tone Snapshot

Entire Governing Council

27 Members0

Executive Board

6 Members0.06

Explainer - ECB Tone Meter Scores: The Tone Meter gauge displays values from -7.5 to +7.5. Technically the values could print outside this range (full scale is -10 to +10) but in practice the composite value rarely approaches these extremes, and a reduced range makes meaningful shifts more clearly visible. In practice, our experience gives the following as a rough interpretation of the values:

.png)

Tone Evolution

ECB Tone Meter Weekly Update: Dovish Tilt Emerges Ahead of the Quiet Period

By Marta Vilar – MADRID (Econostream) – The ECB’s tone in our ECB Tone Meter moved slightly dovish this week, both for the Governing Council overall and for the Executive Board, as the quiet period began on Thursday. The former settled at 0.00, effectively neutral, while the latter eased to +0.05, remaining marginally positive and therefore still slightly hawkish.

30 January 2026Key Drivers of ECB Tone Meter Movements

Below is a breakdown of key periods, grouped by the dominant communication tone observed:

Post-December Calm: Governing Council Tone Edges Hawkishly, But Only Slightly

- 19 December – 15 January: The ECB Governing Council’s tone remains in hawkish territory and ticks slightly higher. The move reflects modest hawkish shifts from policymakers such as Finland’s Olli Rehn and Estonia’s Madis Müller, who strike a more upbeat note on growth, alongside broader confirmation that current interest-rate levels are appropriate, as emphasized by Greece’s Yannis Stournaras and Portugal’s Álvaro Santos Pereira. The most striking development comes from Belgium’s Pierre Wunsch, who returns after two months of silence to say he has shed his dovish bias and is even open to a rate hike as the next step.

Governing Council Tone Crosses Above Zero, Turning Marginally Hawkish

- 8 – 10 December: For the first time in this cycle, the ECB Governing Council’s tone moves out of dovish territory and into slightly hawkish ground, lifting above zero. The shift follows remarks by Executive Board member Isabel Schnabel, who opened the door to an interest rate hike as the next move, and a shift by several previously dovish Council members who now explicitly support holding rates steady in December, like Lithuania’s Gediminas Šimkus and France’s François Villeroy de Galhau.

November Transition Towards Neutrality: Governing Council Tone Sheds Almost All Bias

- 3 November – 3 December: Policymakers with already hawkish readings remain broadly consistent, while some members who had recently sounded more dovish shift towards a less accommodative stance. At the same time, signals from doves advocating further easing fade. Hawks such as Germany’s Joachim Nagel and Ireland’s Gabriel Makhlouf highlight concerns about persistent services and food inflation. Others, including Executive Board member Isabel Schnabel and Latvia’s Mārtiņš Kazāks, stress the importance of upside inflation risks. Some policymakers, such as Croatia’s Boris Vujčić and Nagel, also strike a more optimistic note on growth. On the dovish side, Greece’s Yannis Stournaras appears comfortable with the current policy stance, while arguments from France’s François Villeroy de Galhau and Finland’s Olli Rehn ring less dovish.

ECB Presser Sees Governing Council Tone Shift Higher as Doves Recede

- 30 October – 3 November: The more measured tone of several dovish Governing Council members after the ECB press conference, combined with a slightly firmer stance from the hawks, has lifted the overall tone of the Council closer to neutral. Doves such as Lithuania’s Gediminas Šimkus shifted from expressing comfort with a potential “risk management cut” to avoiding policy predictions and noting that medium-term indicators are now aligned with the target. France’s François Villeroy de Galhau refrained from pushing back as President Christine Lagarde distanced herself further from another cut, while Finland’s Olli Rehn also sounded less insistent on the need for additional easing than he did after September’s press conference.

Governing Council Neutral Stance Reinforced During IMF Week

- 13 - 17 October: As the IMF week in Washington came to a close, a series of remarks from Governing Council members underscored that the overall tone remained broadly neutral, with most policymakers reluctant to back another cut. Among the strongest voices against such a move wereBundesbank President Joachim Nagel, Austrian National Bank Governor Martin Kocher, and Eesti Pank Governor Madis Müller. Meanwhile, policymakers who had previously pushed more forcefully for additional easing, such as Banque de France Governor François Villeroy de Galhau and Bank of Finland Governor Olli Rehn, softened their tone.

Governing Council Stiffens Tone as Lane Hints at Conditional Easing

- 1 - 12 October: The Governing Council has turned more measured, with several members emphasizing stability and balance. Latvia’s Mārtiņš Kazāks takes a neutral stance, saying rates should stay unchanged unless a major economic shock occurs. He also notes that inflation risks are broadly balanced and that the ECB stands ready to adjust policy in either direction — views echoed by Spain’s José Luis Escrivá. Portugal’s newcomer Álvaro Santos Pereira strikes a similarly cautious tone in his inaugural speech, while Germany’s Joachim Nagel expresses satisfaction with the current stance and Estonia’s Madis Müller sounds slightly upbeat about the economy. ECB President Christine Lagarde repeats that policy is in a “good place,” and Vice President Luis de Guindos underlines that current rates are appropriate. By contrast, Chief Economist Philip Lane introduces the first dovish nuance in months, suggesting an emerging easing bias: if downside risks were to intensify, another rate cut would be warranted, whereas upside risks would argue for holding steady.

The Executive Board Sharpens Its Hawkish Tone

- 18 - 30 September: Previously dovish members of the Executive Board begin to sound more hawkish. ECB Vice President Luis de Guindos emphasizes that the risk of undershooting is “not very high” and characterizes inflation risks as two-sided. While this marks a slightly more hawkish stance, he notably avoids outlining any upside risks to inflation when pressed. More striking is Executive Board member Piero Cipollone’s assessment of the economy, which he describes as “surprisingly resilient” and performing “pretty well.” Echoing de Guindos, Cipollone also notes that inflation risks are balanced and, unsurprisingly, endorses President Christine Lagarde’s “good place” narrative.

Doves Take Flight: Prominent Voices Push Back Against Lagarde

- After 12 September: Following ECB President Christine Lagarde’s hawkish press conference, some of the usual hawkish figures (Estonia’s Madis Müller, Germany’s Joachim Nagel, and Slovakia’s Peter Kažimír) line up in support of the pause and Lagarde’s stance. But staunch doves push back: France’s François Villeroy de Galhau argues markets overreacted and calls another cut “entirely possible,” while Finland’s Olli Rehn lays detailed groundwork for further easing, warning the outlook is more fragile than it appears. Lithuania’s Gediminas Šimkus reiterates his “Santa Claus” reference to a December cut, and ECB Vice President Luis de Guindos drops the inflationary concerns he voiced in late August, despite describing the current rate level as “appropriate”. Latvia’s Mārtiņš Kazāks cautions that delaying the ETS could have a “sizeable” effect on inflation projections.

Dovish Tilt: Doves Reemerge After Summer Break

- 31 August - 2 September: A handful of dovish voices break their silence. Finland’s Olli Rehn, who had already hinted at downside risks, now stresses more concern over inflation undershooting. Lithuania’s Gediminas Šimkus openly raises the possibility of a rate cut as early as October or December.

Summer Hawkish Tilt: Only Hawks Break Usual Holiday Silence

- 5 - 29 August: During an otherwise quiet stretch, the few comments that surface are muted and lean toward staying on hold. ECB President Christine Lagarde downplays the trade deal’s impact despite higher-than-expected tariffs. Germany’s Joachim Nagel stresses the high bar for another cut, while even doves like Finland’s Olli Rehn argue an “insurance cut” isn’t needed. France’s François Villeroy de Galhau limits his remarks to dovish takes on trade, avoiding policy calls. ECB Vice President Luis de Guindos strikes a balanced note, describing inflation risks carefully and calling the current rate “appropriate.”

New Hawkish Turn Post-Presser: Doves Less Vocal, Majority Content With Pause

- 25 – 29 July: Most policymakers signal comfort with maintaining the pause. Spain’s José Luis Escrivá even speaks of an “end of the cycle.” None point to cuts as the next step, with Finland’s Olli Rehn offering only the faintest suggestion to that effect. Some doves, such as Executive Board member Piero Cipollone, avoid fueling or dismissing expectations of further easing, though they continue to lean on familiar dovish arguments.

Methodology

Each comment made by an individual policymaker is assessed and assigned a score on a scale from +10 to -10, where +10 represents the most hawkish position and -10 the most dovish. Importantly, these scores are given in absolute terms, regardless of where the ECB is in the current monetary policy cycle and what the historical bias of each policymaker is.

In our ECB Tone Meter we include only remarks in which a policymaker’s personal stance is clearly expressed or can be confidently inferred. While we apply a consistent framework, we acknowledge that there is an inherent degree of subjectivity in interpreting tone and intent.

Still, our experience suggests that this approach captures policy shifts early and reliably. The result is a unique, real-time snapshot of the evolving policy mood in Frankfurt — helping you spot shifts, trends, and turning points as they happen.